Credit Cards

This page does not contain links to all the available credit cards. If there is a card you are interested in obtaining that isn’t listed below, please email us at TravelMore@360traveltips.com. With some of the offers shown below, we’ll earn a commission if you click through and are approved for the card. Thank you very much for supporting our efforts. Any opinions below belong to 360 Travel Tips and not the credit card companies.

We make every effort to update this page to reflect current information, but welcome offers and benefits are continuously changing. Descriptions below do not contain all benefits, and we recommend reading the terms and conditions for each card before applying.

Please email us if a link does not take you to the correct page TravelMore@360traveltips.com

Recommended American Express Cards

PERSONAL

American Express Platinum

Welcome Offer: 100,000 Membership Reward Points after spending $8,000 in the first 6 months of membership. Other benefits: $200 annual airlines credits, $240 annual digital entertainment credit, Global Airport Lounge access, $100 annual credit to Saks, Walmart+ membership, $200 annual Uber credits, $300 annual Equinox credit, $189 Clear credit, earn-5x points on flights and hotels booked on Amex Travel. Annual fee: $695

American Express Gold

Welcome Offer: 60,000 Membership Reward Points after spending $6,000 in the first 6 months of membership. Other benefits: $120 annual dining credit to select restaurants, $10 monthly Uber credit, 4X points at restaurants and supermarkets, 3X points for flights booked on Amextravel.com Annual fee: $250

American Express Everyday

Welcome Offer: Earn 10,000 Membership Rewards® Points after you spend $2,000 in qualifying purchases on the Card within your first 6 months of Card Membership. Other benefits: Use your Card 20 or more times on purchases in a billing period and earn 20% extra points on those purchases less returns and credits. Earn 2X Points at U.S. Supermarkets on up to $6,000 per year in purchases (then 1x) 2X Membership Rewards® Points at AmexTravel.com You can earn double Membership Rewards® points on every dollar of eligible travel purchases—such as prepaid (booked and paid in advance) hotel stays, vacation packages and cruises—when you use your Card to book your trip through AmexTravel.com. NO ANNUAL FEE¤ and NO ANNUAL FEE for Additional Card

BUSINESS

Blue American Express Business Plus

0.0% introductory APR on purchases for 12 months from the date of account opening. After that your APR will be a variable rate, 18.49% - 26.49%, based on your creditworthiness and other factors as determined at the time of account opening. 2X POINTS On Purchases, Up to $50K Per Calendar Year With no category restrictions. 1X POINTS On Purchases thereafter. NO ANNUAL FEE

American Express Business Platinum

Welcome Bonus: 120,000 Membership Rewards® Points after you spend $15,000 in qualifying purchases on the Card within your first 3 months of Card Membership. $200 annual airlines credits, $189 CLEAR Plus Credit, Global Lounge Collection access, 5x points on flights and hotels booked on Amex Travel. 1.5X POINTS On Key Business Categories & on Purchases of $5k or More , Enroll and get up to $400 in statement credits per year (up to $200 back semi-annually) toward U.S. purchases with Dell Technologies on the Business Platinum Card, Enroll and get up to $360 in statement credits per year (up to $90 back per quarter) for purchases with Indeed on the Business Platinum Card, Up to $150 in statement credits per year for eligible annual prepaid business plan purchases with Adobe on Creative Cloud for teams or Acrobat Pro DC with e-sign for teams on the Card, Enroll and get up to $120 in statement credits per year (up to $10 back per month) for wireless telephone service purchases made directly with a wireless provider in the U.S. on the Business Platinum Card, Business Platinum Card Concierge is a complimentary service, Annual Fee: $695

American Express Business Gold

Welcome Bonus: Limited Time Elevated Bonus of 130,000 (was 70,000) Membership Rewards® points after you spend $10,000 in eligible purchases on the Card within your first 3 months of Card Membership. 4X POINTS On 2 Select Categories Where Your Business Spends the Most Each billing cycle up to $150,000 each calendar year. Annual Fee $295

American Express Business Green

Earn 15,000 Membership Rewards® points after you spend $3,000 in eligible purchases on the new Card within the first 3 months of Card Membership. 2X POINTS On Eligible Purchases at amextravel.com. Annual Fee $95

Recommended Chase Cards

PERSONAL

Chase Sapphire Preferred

Welcome Bonus: 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. Earn up to $50 in statement credits each account anniversary year for hotel stays purchased through Chase Ultimate Rewards. Earn 5x total points on travel purchased through Chase Ultimate Rewards®, excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit $50 Annual Ultimate Rewards® Hotel Credit. Earn 5x total points on Lyft rides through March 31st, 2025. 3x points on dining at restaurants worldwide. Earn 3x points on select streaming services and some online grocery purchases. Earn 2x points on all other travel purchases. Promotion runs through December 31st, 2023. Complimentary access to DashPass - a membership for both DoorDash and Caviar. No foreign transaction fees. $95 annual fee

Chase Sapphire Reserve

Welcome Bonus: 60,000 bonus points after you spend $4,000 on purchases in the first 3 months. Automatically receive up to $300 in statement credits as reimbursement for travel purchases charged to your card each account anniversary year. 5x total points on flights when you purchase travel through Chase Ultimate Rewards® after the first $300 is spent on travel purchases annually. Earn 10x total points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® after the first $300 is spent on travel purchases annually. Earn 10x total points on Chase Dining purchases through Chase Ultimate Rewards when you make prepaid restaurant reservations, order takeout or join our virtual cooking events. Earn 3x points on other travel worldwide, after the first $300 is spent on travel purchases annually. Earn 3x points on other dining, including eligible delivery services, takeout and dining out. Global Entry or TSA PreCheck® or NEXUS Fee Credit - Receive one statement credit of up to $100 every four years as reimbursement for the application fee charged to your card. Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select. Earn 10x points on Lyft rides through March 31, 2025. Get complimentary access to DashPass - a membership for both DoorDash and Caviar.

Chase Freedom Unlimited

EARN A $200 BONUS after spending $500 on purchases in your first 3 months from account opening. Unlimited 1.5% cash back on everything you buy. Earn 5% on TRAVEL purchased through Chase Ultimate Rewards. Earn 3% on DINING at restaurants, including takeout and eligible delivery services. Earn 3% on DRUGSTORE purchases. Earn 5% on combined gas and grocery store purchases up to $12,000 spend in first year (excludes Target and Walmart) No Annual Fee.

Chase Freedom Flex

Welcome Bonus: $200 bonus (can be converted to 20,000 Ultimate Reward Points if you have a Sapphire card) after spending $500 on purchases in your first 3 months. Earn 5% cash back on different categories like gas stations, grocery stores (excluding Target® and Walmart®) and select online merchants on up to $1,500 in total combined purchases each quarter you activate. 5% on TRAVEL purchased through Chase Ultimate Rewards®, 3% on DINING at restaurants including takeout and eligible delivery services, 3% on DRUGSTORE purchases, Earn 5% on combined gas and grocery store purchases up to $12,000 spend in first year (excludes Target and Walmart), 1% on all other purchases.. No Annual Fee.

BUSINESS

(make sure you scroll on the link until you see the picture of the card you want, then hit the application button.)

Ink Business Cash

Welcome Bonus: 75,000 bonus points when you spend 6,000 within the first 3 months. (You may see a "pop-up" saying the "offer isn't available", but click through the "pop-up" for the current listed offer) You’ll earn 5% Cash Back rewards total for each $1 of the first $25,000 spent each account anniversary year on combined purchases in the following rewards categories: office supply stores; internet, cable, and phone services (4% additional Cash Back rewards on top of the 1% Cash Back rewards earned on each purchase). 2% Cash Back rewards total for each $1 of the first $25,000 spent each account anniversary year on combined purchases in the following rewards categories: gas stations and restaurants. No Annual Fee.

Ink Business Unlimited

Welcome Bonus: 75,000 bonus points when you spend 6,000 within the first 3 months from account opening. (You may see a "pop-up" saying the "offer isn't available", but click through the "pop-up" for the current listed offer) You will earn 1.5x points on all purchases with no annual fee.

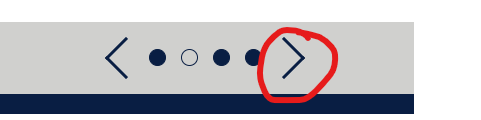

Business Ink Preferred

This card can be used as a “gateway” card in lieu of the Personal Chase Sapphire Preferred or Reserve cards. Earn 100,000 bonus points with the Ink Business Preferred when you spend $8,000 within the first 3 months of account opening. (You may see a "pop-up" saying the "offer isn't available", but click through the "pop-up" for the current listed offer) You will earn 3 points total for each $1 of the first $150,000 spent each account anniversary year on combined purchases in the following rewards categories: shipping; social media and search engine advertising; travel; internet, cable, and phone services. $95 Annual Fee.

Note: To find the correct application for the Preferred card, click the arrow that looks like the one circled that you will find in the middle of the page (do not apply for the Premier card by mistake—it looks very similar and comes up first).

Recommended CapitalOne Card

CapitalOne Venture X

Welcome offer: 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months. Receive a $300 annual credit for bookings through Capital One Travel. Get 10,000 bonus miles (equal to at least $100 towards travel) every year, starting on your first anniversary. Receiver up to a $100 credit for Global Entry or TSA PreCheck. Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network. Unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel, plus unlimited 2X miles on all other purchases. $395 Annual Fee.

Recommended Card - Best Card for Paying Rent

BILT

No Welcome Bonus, but 1X POINTS ON RENT PAYMENTS WITHOUT THE TRANSACTION FEE (UP TO 100,000 POINTS EACH CALENDAR YEAR.) 2X points on travel, 3X points on dining. Earn more points on Rent Day (the first of each month) with 6X on dining, 4X on travel, and 2X on other purchases (except rent).

Recommended Airline Cards

Southwest Airlines - Personal Premier

50,000 points after $1,000 spend in the first 3 months. 3X points on Southwest purchases, 2X points with Rapid Rewards(R) hotel and car partners, 2X points on local transit and rideshare, 2X internet, cable, phone services, and select streaming, 1X on all other purchases. 6000 bonus points each year upon card renewal. 2 EarlyBird Check-Ins each year. 10,000 Companion Pass qualifying points each year, $99 Annual Fee (This link brings you to all available Southwest Cards if you are interested in any of their other cards)

Southwest Airlines - Business Premier

60,000 points after $4,000 spend in first 3 months. 3X points on Southwest purchases, 2X points with Rapid Rewards(R) hotel and car partners, 2X points on local transit and rideshare, 2X internet, cable, phone services, and select streaming, 1X on all other purchases. 6000 bonus points each year upon card renewal. 2 EarlyBird Check-Ins each year. 10,000 Companion Pass qualifying points each year, Earn 1,500 tier qualifying points (TQPs) toward A-List status for every $10,000 spent in purchases annually. $99 Annual Fee ($199 for Performance Card)

Recommended Hotel Cards

Hyatt

World of Hyatt Business Credit Card

Welcome Bonus: 60,000 points after you spend $5,000 on purchases in the First 3 Months. 4 World of Hyatt Bonus Points for each $1 USD spent on purchases made at Hyatt hotels and resorts (including at participating restaurants and participating locations that are owned, managed, franchised or licensed by Hyatt Corporation or its subsidiaries or affiliates), on FIND experiences purchased directly at hyatt.com/FIND, at participating SLH properties, and on Lindblad Expedition experiences purchased directly through the World of Hyatt Program. 2X Points for each $1 USD spent on fitness club and gym memberships. 2x Points on your top categories each quarter. Up to $100 Annual Hyatt Credit. $199 Annual Fee

Hilton

Hilton Surpass Card/American Express

Welcome Bonus: 130,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the card within your first 3 months. 12X points on hotels & resorts For eligible purchases at hotels and resorts in the Hilton portfolio. 6X points on dining at U.S. restaurants, including takeout and delivery. 6X points on groceries at U.S. supermarkets. 6X points on gas at U.S. gas stations. 3X points for each dollar spent on other eligible purchases. Earn a free night reward from Hilton Honors after you spend $15,000 on eligible purchases on your card in a calendar year. 10 complimentary airport lounge visits each Priority Pass Membership year. Enjoy complimentary Hilton Honors Gold status. no fees for foreign transactions. $95 Annual Fee

Hilton Aspire Card/American Express

Welcome Bonus: 175,000 Hilton Honors Bonus Points after you spend $8,000 in purchases on the card within your first 6 months. 14X points on Hilton hotels and resorts, 7X points on flights booked directly with airlines or amextravel.com; on car rentals booked directly from select car rental companies; at U.S. restaurants. 3X points for each dollar spent on other eligible purchases. Complimentary Hilton Diamond status, $400 annual Hilton Resort Statement Credit, $550 Annual Fee.

MarriotT

There are several options for Marriott co-branded credit cards. If you aren’t sure which one is right for you, please feel free to email us: Travelmore@360TravelTips.com

Marriott Bonvoy Boundless

Welcome Bonus: 3 Free Night Awards up to a 150,000 Total Point Value (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months. Earn up to 17X total points for every $1 spent at hotels participating in Marriott Bonvoy = Earn 6X points with Marriott Bonvoy Boundless® Credit Card + Earn up to 10X points from Marriott for being a loyalty member + Earn up to 1X points from Marriott with Silver Elite status. Earn 3X points per $1 on the first $6,000 spent in combined purchases each year on gas stations, grocery stores, and dining. Earn 2X points per $1 spent on other travel purchases. Earn 2X points per $1 spent on all other purchases. Receive 15 Elite Night Credits per calendar year*Opens Marriott Bonvoy Boundless offer details overlay and automatic Silver Elite status each account anniversary year as a cardmember. Earn one Elite Night Credit toward Elite status for every $5,000 you spend. Path to Gold status when you spend $35,000 on purchases each calendar year. Enjoy a Free Night Award every year after your account anniversary, valid for a one-night hotel stay at a property with a redemption level up to 35,000 points. Certain hotels have resort fees. Complimentary in-room, premium internet access while staying at participating Marriott Bonvoy® hotels. $95 Annual Fee

Marriott Bonvoy Bold

Welcome Bonus: 30,000 bonus points after you spend $1,000 in purchases in your first 3 months from account opening. No annual fee/ Earn up to 14X total points for every $1 spent at hotels participating in Marriott Bonvoy. Earn 3X points with Marriott Bonvoy Bold® Credit Card + Earn up to 10X points from Marriott for being a loyalty member + Earn up to 1X points from Marriott with Silver Elite status. Earn 2X points per $1 spent on other travel purchases. Earn 1X points per $1 spent on all other purchases. Receive 15 Elite Night Credits per calendar year qualifying you for Silver Elite Status. No Annual Fee

Marriott Bonvoy Bountiful

Welcome Bonus: 85,000 Bonus Points After you spend $4,000 on purchases in your first 3 months from your account opening. Earn up to 18.5X total points for every $1 spent at hotels participating in Marriott Bonvoy = Earn 6X points with Marriott Bonvoy Bountiful® Credit Card + Earn up to 10X points from Marriott for being a loyalty member + Earn up to 2.5X points from Marriott with Gold Elite status. 1,000 Bonus Points per each stay at a hotel participating in Marriott Bonvoy. Earn 4X points per $1 on the first $15,000 spent in combined purchases each year on grocery stores and dining. Earn 2X points per $1 spent on other travel purchases. Earn 2X points per $1 spent on all other purchases. Receive 15 Elite Night Credits per calendar year and automatic Gold Elite status each account anniversary year as a cardmember. Enjoy a Free Night Award every calendar year, after $15,000 in spend, valid for a one-night hotel stay at a property with a redemption level up to 50,000 points. $250 Annual Fee.

IHG

IHG One Rewards Premier

Welcome Bonus: EARN 4 FREE NIGHTS (each Free Night valued at up to 40,000 points) After spending $3,000 in the first 3 months from account opening. Up to 26X at IHG Hotels & Resorts = 10X points with this card + Up to 10X points from IHG® for being an IHG One Rewards Member + Up to 6X points from IHG® with Platinum Elite Status, a benefit of this card. Earn 5X points for every dollar spent on travel and hotels. Earn 5X points for every dollar spent at gas stations. Earn 5X points for every dollar spent at restaurants, including takeout and eligible delivery. Earn 3X points for every dollar spent on all other purchases. Automatic Platinum Elite Status as long as you remain an IHG One Rewards Premier Cardmember. Redeem 3 nights, get 4th night free when you redeem points for a consecutive four-night IHG® hotel stay, you can receive a fourth Reward Night free redeemable at that same hotel during that same stay. Anniversary Free Night Earned each account anniversary year with a current point redemption cap of 40,000 points. You can also use existing points from your IHG One Rewards account to redeem your Anniversary Night at hotels above the 40,000-point redemption level. Trip cancellation / Interruption insurance If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $5,000 per person and $10,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels. Global Entry, TSA PreCheck® or NEXUS Statement Credit Receive a statement credit of up to $100 every four years as reimbursement for the application fee for Global Entry, TSA PreCheck or NEXUS when charged to your card. Up to $50 United® Airlines. Travel Bank Cash each year Receive up to $50 United® Travel Bank Cash each calendar year after registering your IHG One Rewards Premier Credit Card with your MileagePlus® account. $99 Annual Fee

IHG One Rewards Traveler

EARN 80,000 BONUS POINTS after spending $2,000 on purchases in the first 3 months from account opening. Up to 17Xat IHG Hotels & Resorts 5X points with this card Up to 10X points from IHG® for being an IHG One Rewards Member. Up to 2X points from IHG® with Silver Elite Status, a benefit of this card. Monthly bills Earn 3X points for every dollar spent on utilities, internet, cable, and phone services and select streaming services. Gas stations Earn 3X points for every dollar spent at gas stations. Dining Earn 3X points for every dollar spent at restaurants, including takeout and eligible delivery. All other purchases Earn 2X points for every dollar spent on all other purchases. Automatic Silver Elite Status as long as you remain an IHG One Rewards Traveler Cardmember. Redeem 3 nights, get 4th night free when you redeem points for a consecutive four-night IHG® hotel stay, you can receive a fourth Reward Night free redeemable at that same hotel during that same stay. No Annual Fee.

IHG One Rewards Premier Business

EARN 140,000 BONUS POINTS after spending $3,000 on purchases in the first 3 months from account opening. Up to 26X at IHG Hotels & Resorts = 10X points with this card + Up to 10X points from IHG® for being an IHG One Rewards Member + Up to 6X points from IHG® with Platinum Elite Status, a benefit of this card. Earn 5X points on travel and hotels. Earn 5X points at gas stations. Earn 5X points at restaurants. Select business Earn 5X points for every dollar spent on social media, search engine advertising, and office supply stores. Earn 3X points for every dollar spent on all other purchases. Automatic Platinum Elite Status. Redeem 3 nights, get 4th night free when you redeem points for a consecutive four-night IHG® hotel stay, you can receive a fourth Reward Night free redeemable at that same hotel during that same stay. Anniversary Free Night Earned each account anniversary year with a current point redemption cap of 40,000 points. Trip cancellation / Interruption insurance . Global Entry, TSA PreCheck® or NEXUS Statement Credit $99 Annual Fee